* Any views expressed in this opinion piece are those of the author and not of Thomson Reuters Foundation.

In a globalised world, the success of climate change adaptation in one country will determine the risks and benefits for others

Adaptation to climate change is a topic of acute importance to vulnerable countries. But adaptation should be a serious concern for all nations, rich and poor. In a globalised world, the success of adaptation in one country will determine the risks and benefits for others.

One of the main reasons for this is because some climate risks are borderless. Climate impacts in one country will have a knock-on effect in other countries, requiring them to adapt. But what kind of borderless impacts can countries expect, and how might they go about identifying and assessing them?

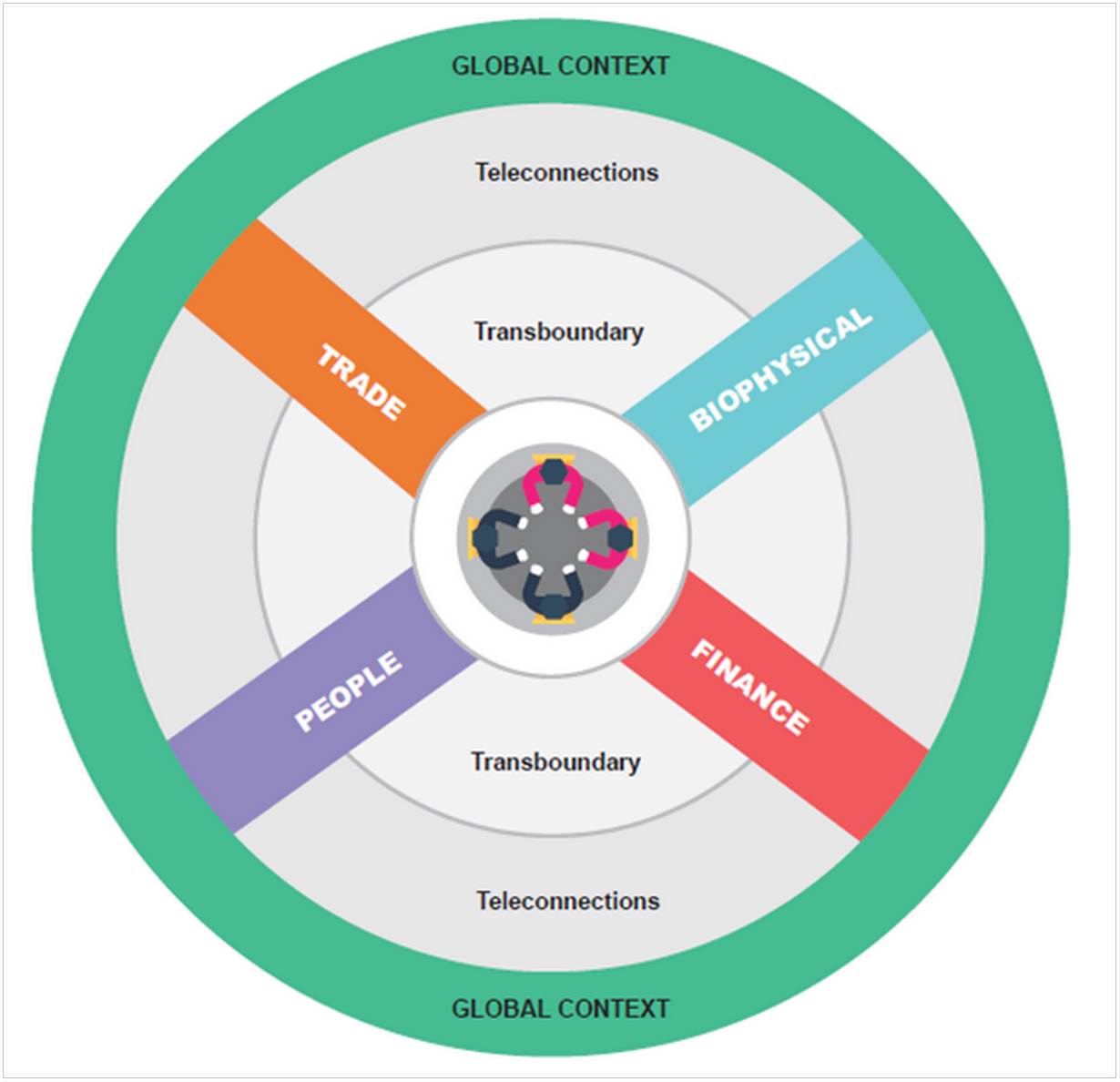

Researchers at the Stockholm Environment Institute have identified four pathways that can transfer climate risks over national borders:

- international flows of goods and services (trade pathway)

- resources and ecosystem services (biophysical pathway)

- capital and remittances (finance pathway)

- migrants and tourists (people pathway)

Our framework also includes changes to the global context in which adaptation occurs - for example levels of insecurity, peace and conflict, and cooperative global governance.

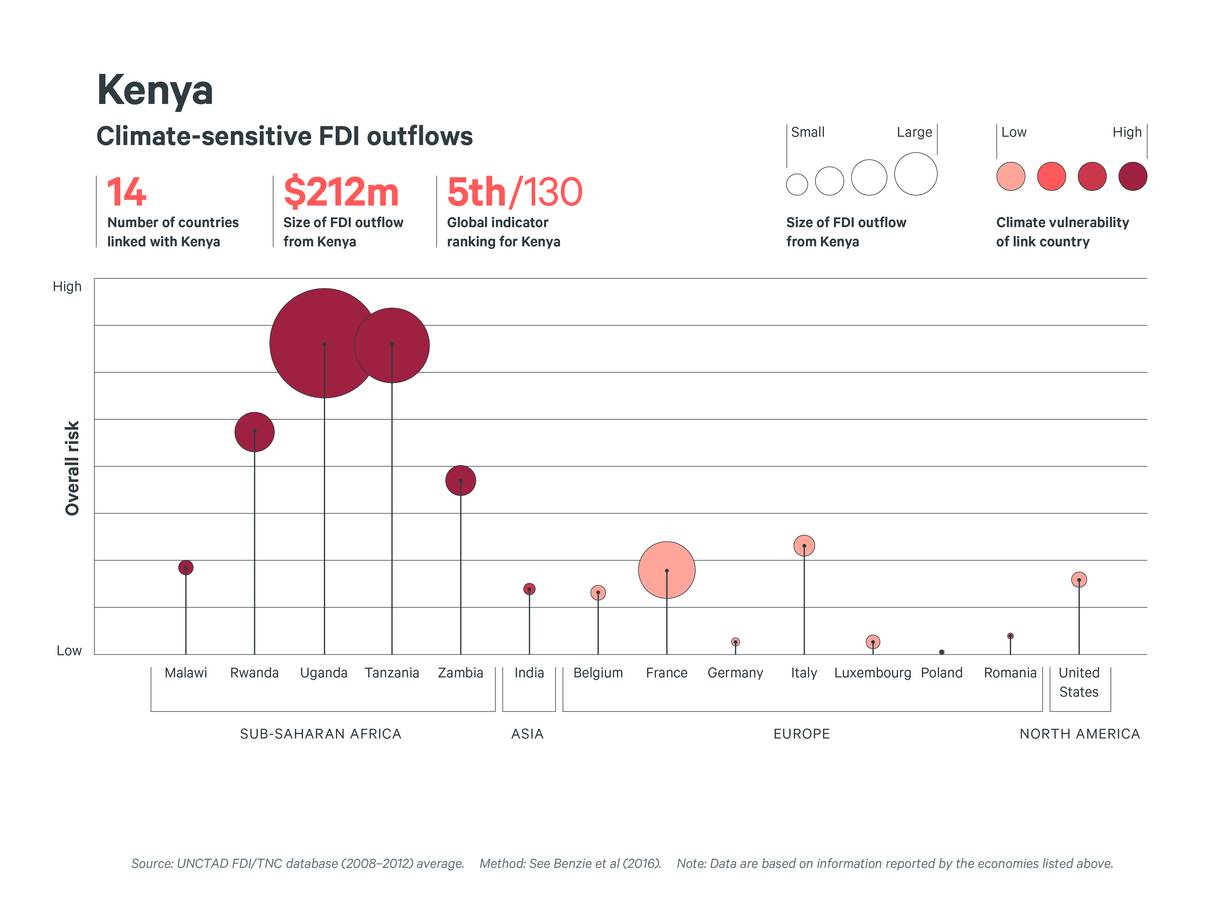

We have begun to assess exposure to borderless climate risks by developing a global index. But the framework really becomes useful when applied to countries. For example, our work shows how Kenya is exposed to climate risks in other countries through its foreign direct investments (FDI).

Climate change impacts, such as droughts, storms, floods and sea level rise, will affect the return on investment from FDI in other countries.

Long-term changes in climate may ultimately affect asset value, creating a “risk” for Kenyan investors related to their acquisitions and investments abroad. FDIs flowing from Kenya include public investments made by pension funds, and assets held by Kenya-based businesses.

As a regional financial hub, most of Kenya’s investment is targeted in neighbouring countries in East Africa. Kenya directs FDI into only a relatively small number of countries and its overall FDI outflow is relatively small by global standards (averaging $212 million per year between 2008 and 2012).

The overall risk of these investments is made up of two factors: the size of the “flow” or total investment (in millions of dollars) – indicated by the size of the circles; and the climate vulnerability of those target countries – indicated by the shading of the circle (with darker indicating higher vulnerability, using data from the ND-GaIN index). The overall risk is shown by the height of the “stalk”; the taller the stalk the higher the risk.

In addition to small investments in European countries (most notably, France), Kenya’s climate-sensitive FDI outflows are concentrated in East Africa, with Uganda and Tanzania representing the highest overall risk. To manage these borderless climate risks, Kenya could cooperate with its neighbours through existing regional forums such as the East African Community and the Africa Adaptation Knowledge Network (AAkNet) to promote effective adaptation in the neighbouring countries in which it invests.

Regional resilience in East Africa would lower Kenya’s FDI-related climate risk. But regional cooperation on adaptation brings multiple benefits by also tackling other shared challenges, such as transboundary ecosystems, drought and migration.

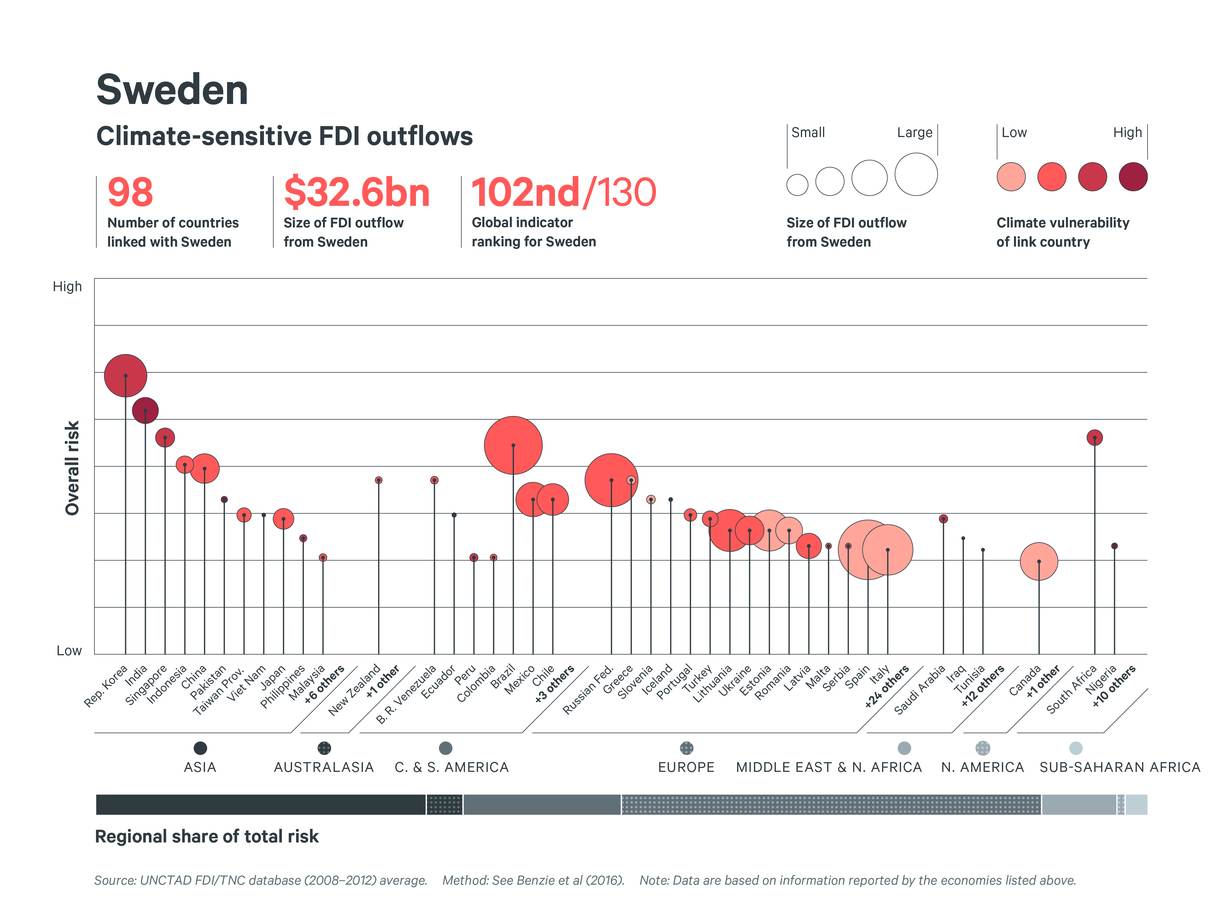

Kenya’s risk profile can be contrasted with that of Sweden, which, as a rich country that is deeply integrated into global markets, invests a far higher sum of FDI (total $32.6 billion per year) in a larger number of markets. Sweden’s risk profile is much more evenly spread across global regions, with Asia, Central and South America and Europe dominating.

The most significant share of Sweden’s FDI by volume is invested within Europe, but its climate-sensitive FDI risk is concentrated in economies further afield, including India, Singapore, China, Brazil, South Africa and Russia. By having a broad portfolio of investments abroad, Sweden hedges its exposure to climate risks. This is a strategy that can work for managing borderless risks via the “finance pathway”.

Nevertheless, the transmission of climate risk through the finance pathway presents an adaptation challenge to Sweden. To reduce its own exposure to borderless climate risks, Sweden will need to bolster global climate resilience by contributing more – and encouraging other partner countries to contribute more – to international adaptation efforts. This would particularly include the provision of adequate finance for adaptation in third countries.

Although adaptation planners are always faced with uncertainty about future climate changes, it is uncertainty about future climate finance provisions that is troubling the African Group of Negotiators at the moment, according to Seyni Nafo, the group’s chair.

Almost all countries fail to acknowledge the importance of borderless climate risks in their National Adaptation Plans. But the evidence suggests it is essential for climate policy makers to do this as a starting point for working out how to address those risks.

Our Standards: The Thomson Reuters Trust Principles.