Ethical investing, which weighs up companies' commitment to environmental, social and governance issues - or ESG - has become one of the fastest growing areas of finance

By Lin Taylor

LONDON, May 27 (Thomson Reuters Foundation) - As wealth gaps widen between rich and poor amid a global pandemic and cost of living crisis, a growing number of workers and investors are pushing to rebuild business to prioritise people, not just profits.

Be it flexible working, diversity goals, or climate targets, some companies are heeding the call to show off their ethical credentials - and for many, it is starting to pay off.

Sustainable investing has exploded in recent years, reaching $35.3 trillion by the start of 2020, according to the Global Sustainable Investment Alliance.

Despite the buzz, some have questioned whether the ESG rankings used to measure a company's ethical rating match up with the reality of their business practices.

Tech mogul Elon Musk called ESG a "scam" after his electric vehicle company Tesla was dropped from a major ESG index in May.

What is ESG?

Ethical investing, which weighs up companies' commitment to environmental, social and governance issues - or ESG - has become one of the fastest growing areas of finance.

It covers a range of issues from the diversity of a workplace to its carbon emissions.

"It could be privacy, freedom of association, freedom of expression, access to water, nutrition, labour rights," said Caroline Rees, co-founder and director of Shift, a non-profit working at the nexus of business and human rights.

Until now companies have often focused most on the environment - or E - aspect of the ratings because of the long-term risks posed by climate change.

But analysts say that things have started to change – with the emphasis shifting to the S.

A mining company, for example, would consider whether its operations could displace a community, cut off access to hunting grounds, or poison drinking water - concerns that previously belonged primarily to governments.

"It's a threshhold. When you hit that level that it undermines people's basic dignity and equality ... that's when companies need to be taking action," Rees said.

Governments are also pushing firms to take action on their social impacts.

Since 2017, British companies with over 250 employees are required to submit gender pay gap figures in a bid to close the wage difference between men and women.

In April, the Financial Conduct Authority - the country's financial watchdog - went a step further and recommended that women should make up at least 40% of boards, as part of a range of business diversity targets.

Does it make financial sense?

In short, yes, experts say.

The market tends to reward companies that minimise their exposure to risk, as opposed to firms that sell controversial products or use an insecure labour force, for example, which can hurt profits and increase volatility.

"Studies have shown that managing social factors such as diversity and inclusion, and human capital management, have a strong investment case," said Michael W. Frerichs, the Illinois state treasurer in the United States.

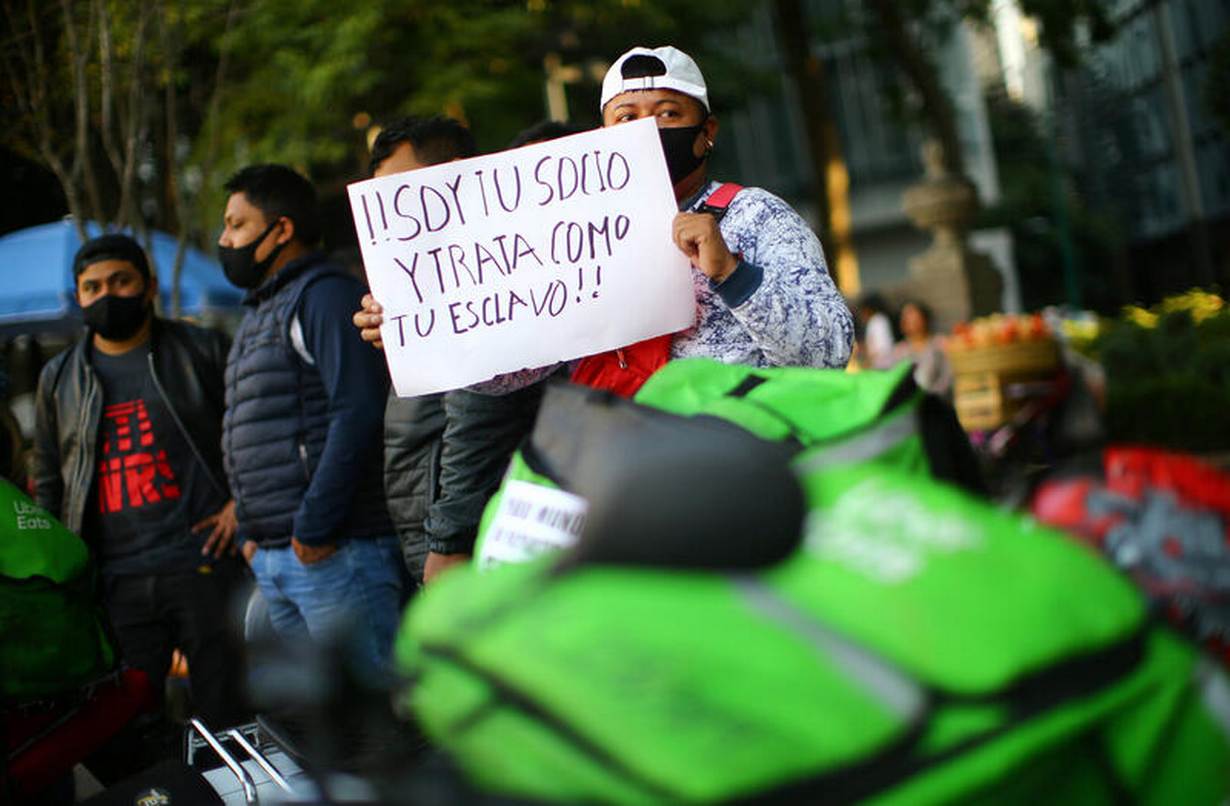

Shares in food delivery app Deliveroo plunged by as much as 30% after the company made its stock market debut in March 2021, with some top investment firms citing a lack of rights for riders as an investment risk.

Younger generations are also more likely to invest in, promote and purchase from socially responsible companies, according to global financial research company MSCI.

Firms that roll back safety conditions or benefits for workers risk creating an environment where staff are more likely to strike or become less productive, Frerichs said.

"Although those decisions to cut costs might make you profitable in the next month or the next quarter, they could lead to an erosion in value of your company long-term," he said.

How do you measure the impact of ESG?

It can be challenge. Some aspects such as the amount of planet-warming carbon released by business activities can be measured and compared.

But a company's social impact on the people and communities around it - and their efforts to combat negative effects - can be more difficult to track and pin down.

For years, companies have been able to make public declarations on their commitments with no clear or universal standards to which they could be held accountable.

But an increasing number of regulators - and almost all stock exchanges - now call for disclosure on social impacts, putting their claims to the test, said Bastien Buck, chief of standards at the Global Reporting Initiative.

"Sometimes they focus on single issues, some embrace certain international issues and others have a more holistic view," he said, calling for the S in ESG to be standardised and written into law.

"It needs to move from voluntary to mandatory, eventually. If you mandate this type of disclosure, you are taking care of many issues."

Regulators in the European Union and the U.S. are looking to tighten rules over corporate ESG claims. The U.S. Securities and Exchange Commission (SEC) in May proposed a pair of rule changes aimed at stamping out unfounded claims by funds on their ESG credentials.

Some financial experts argue ESG ratings are mostly used as a marketing ploy, designed to attract investors.

Elon Musk lashed out when Tesla was dropped from S&P Global Inc's flagship ESG index in May. He tweeted: "ESG is a scam. It has been weaponized by phoney social justice warriors."

There is also debate over how ESG initiatives should be measured.

Some, like Musk, believe the ratings should reward companies that do the most for the planet and society. Others, including firms like S&P that produce the scores, say they are meant to show how much risk a company faces of seeing its stock values fall as a result of ESG factors.

Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!

— Elon Musk (@elonmusk) May 18, 2022

ESG is a scam. It has been weaponized by phony social justice warriors.

Where to from here?

As billions of dollars are spent rebuilding economies around the world after the COVID-19 pandemic, firms have the opportunity to ensure that human rights become a fundamental part of business models in the future, experts say.

For example, as businesses embrace remote work as a long-term solution, some companies are giving employees the right to disconnect.

Other companies, including Amazon.com and Tesla Inc, are rolling out policies to offer benefits to U.S. employees who may need to access abortion services as some state legislatures impose tighter restrictions.

It is a trend that businesses cannot afford to ignore as firms face scrutiny over their practices, said Rees.

"We cannot expect business to thrive financially, reputationally, or in any other regard, unless these practices change and respect for people becomes routine to the ways in which business gets done," she said.

RELATED STORIES

INVESTIGATION: Inside Amazon's shadow workforce in Mexico

INVESTIGATION: Risks for South Africa's food couriers surge during the pandemic

OPINION: Companies and investors need to prioritise human rights long after the pandemic

This article was updated on May 27, 2022, to include proposed rule changes by the U.S. SEC.

(Reporting by Lin Taylor @linnytayls, Additional reporting by Matt Blomberg @BlombergMD, Editing by Lin Taylor @linnytayls and Sonia Elks @SoniaElks. Please credit the Thomson Reuters Foundation, the charitable arm of Thomson Reuters, that covers the lives of people around the world who struggle to live freely or fairly. Visit http://news.trust.org)