Facing a cost-of-living crisis as UK inflation climbs to a 30-year high, more people are downloading personal finance apps to help budget for rising food and energy costs

-

Cost-of-living crisis spurs interest in budgeting apps

-

Money management tools report jump in downloads

-

Privacy, ease of use a concern for potential users

By Beatrice Tridimas

LONDON, April 20 (Thomson Reuters Foundation) - When Welsh civil servant Amy Cunningham's water bill went down earlier this year, she used the spare money to top up the gas and electricity "savings pot" in her digital banking account as she braced for higher energy prices.

Cunningham, who set up her first "savings pot" on the Monzo app to put money aside for her wedding, is among a growing number of Britons using personal finance apps to budget as rising energy and food costs push inflation to a 30-year high.

She now splits all her income into such pots, helping her prepare for an expected hike in energy bills this month due to a 54% increase in the price cap by regulators.

"We know exactly now which pot's going up ... and we know that we've got a little surplus money in another pot if we ever need it," said Cunningham, 38, by phone from her home in the town of Merthyr Tydfil in South Wales.

Rising outgoings appear to be driving thousands of people to try money management apps for the first time.

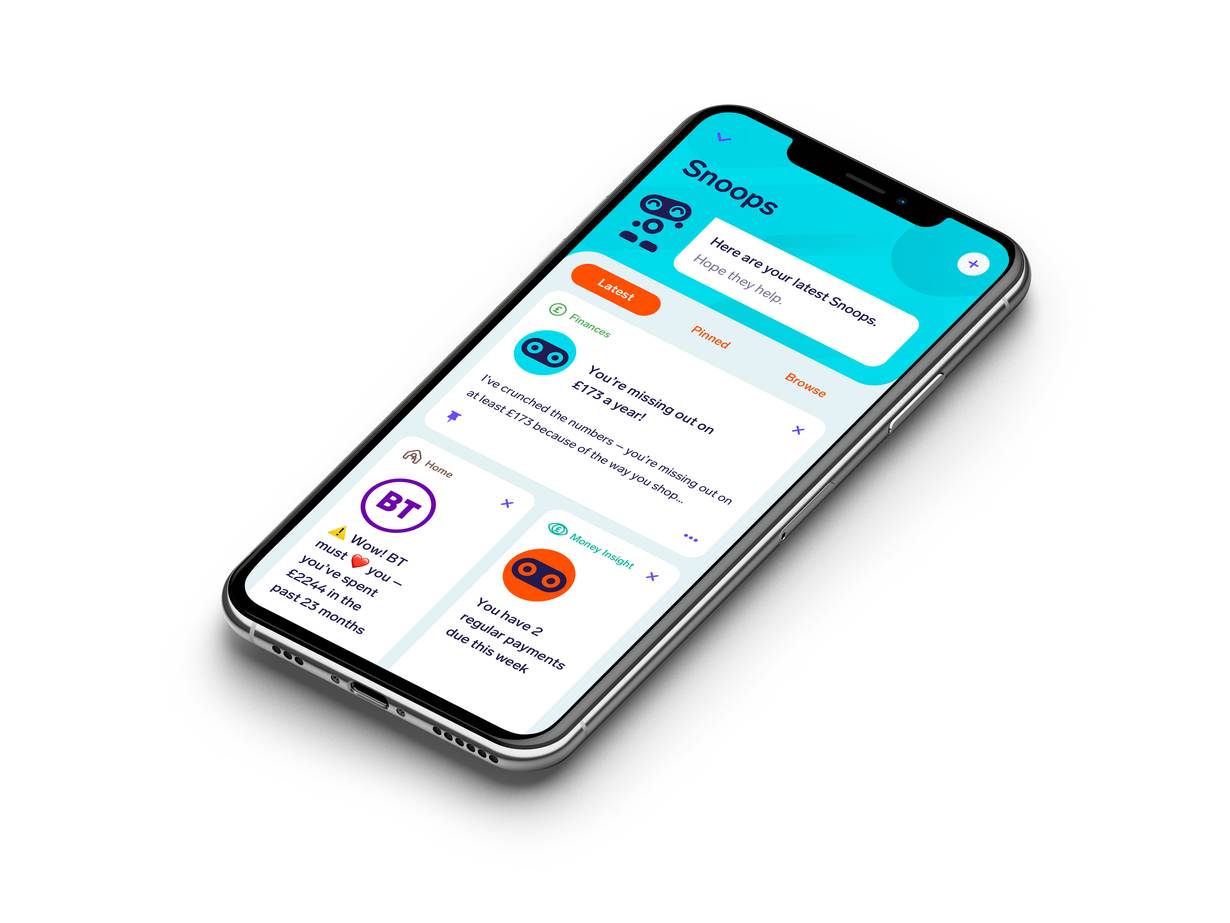

Another such tool, Emma, was downloaded more than 2,000 times every day in January, according to the company, while budget planner app Snoop registered a 56% jump in downloads in the first quarter of 2022 from the previous three months, said co-founder Scott Mowbray.

"This is no doubt down to the pressure people are facing on the cost of living," Mowbray said.

With such users in mind, Snoop recently introduced a cost-of-living calculator that predicts how a user's household bills could increase on the basis of inflation, price cap rises and their spending history.

FINTECH BOOM

The digitisation of banking services and the easing of regulations have helped spark a boom in fintech (financial technology) worldwide, with users from Brazil to Indonesia embracing digital lending apps and budgeting apps.

But privacy advocates have warned that users' data may not be protected on these apps, while financial experts say basic budgeting skills are still needed, and that older people and those who are not comfortable with technology may be excluded.

"Apps are great tools, and if you're digitally native then they're a fantastic tool. But there's a whole cohort of people who are a little bit more averse to technology," said Russell Winnard, chief operating officer of financial education at the Young Enterprise charity.

The average age of a Monzo user is 32, though nearly 100 of the app's users are in their 90s, the company said. Snoop, meanwhile, appears to have a slightly older following, with 40% of customers aged over 45.

Kim Tracey, 58, a journalist from Yorkshire began to manually calculate her expenses from shopping receipts a week before the energy price cap was due to change.

"It's difficult to make the transition (to tech). It's definitely an age-related thing," she told the Thomson Reuters Foundation, adding that she has struggled to find an app that she is comfortable using, and that she trusts.

"Data leaks are clearly a worry. There's potentially a massive downside," she added.

TOO OLD FOR TECH?

In 2018, Britain introduced the Open Banking directive, which facilitates the sharing of bank data, and allowed fintech services to offer users all their banking data in one place.

While the global fintech boom has led to data breaches, especially on digital lending platforms, the British directive has helped boost financial inclusion, according to the Bank of International Settlements (BIS).

Among some 200 firms enrolled in Open Banking in Britain, are fintech companies providing services aimed at helping lower-income or financially vulnerable groups to manage their money, the BIS said.

But budgeting apps alone are no panacea for the rising cost of living, said Anthony Villis, managing director of financial planning company First Wealth.

"(Tech) can only help in terms of being aware of what your situation is," he said. "With the best financial advisors, the best technology, there is only so much you can do, and to say otherwise would be misleading."

Villis runs an Instagram page, Let's Talk About Money, that provides basic personal finance tips to young people, and has seen its following more than double in the last year, he said.

There has also been an explosion in so-called finfluencers, or social media influencers offering financial advice.

Cunningham, who follows several such pages on Instagram, said she did not learn how to budget when she was young, so is now trying to teach her eldest daughter to do so.

"It's been a massive eye opener, and I know I can pass on this learning to the kids," she said. "I wish I'd known this years and years ago, to be in a better position."

"But it's never too old to start."

Related stories:

As AI-based loan apps boom in India, some borrowers miss out

'Silicon Savannah' Kenya targets loan apps abusing customer data

In Egypt, lending apps boost cash-strapped women business owners

(Reporting by Beatrice Tridimas; Editing by Rina Chandran and Helen Popper. Please credit the Thomson Reuters Foundation, the charitable arm of Thomson Reuters, that covers the lives of people around the world who struggle to live freely or fairly. Visit https://news.trust.org)

Our Standards: The Thomson Reuters Trust Principles.